This is an area that is commonly misunderstood by both employers and employees.

With pay items needing to be more specifically mapped as part of Single Touch Payroll, its more important than ever to get this right as it directly affects how it is interpreted and taxed in the hands of the employee when they have their annual Tax Return prepared. It also guides their tax agent as to what if any tax deductions can be claimed against it.

It may seem odd to say this, but getting this wrong can impact team culture. Imagine an employee who receives an unexpected tax bill at tax time. They are highly likely to be less than happy about the unexpected debt and will be asking questions of their employer and payroll officer and will likely instigate discussion regarding it across the team. It’s best to take steps to avoid this situation.

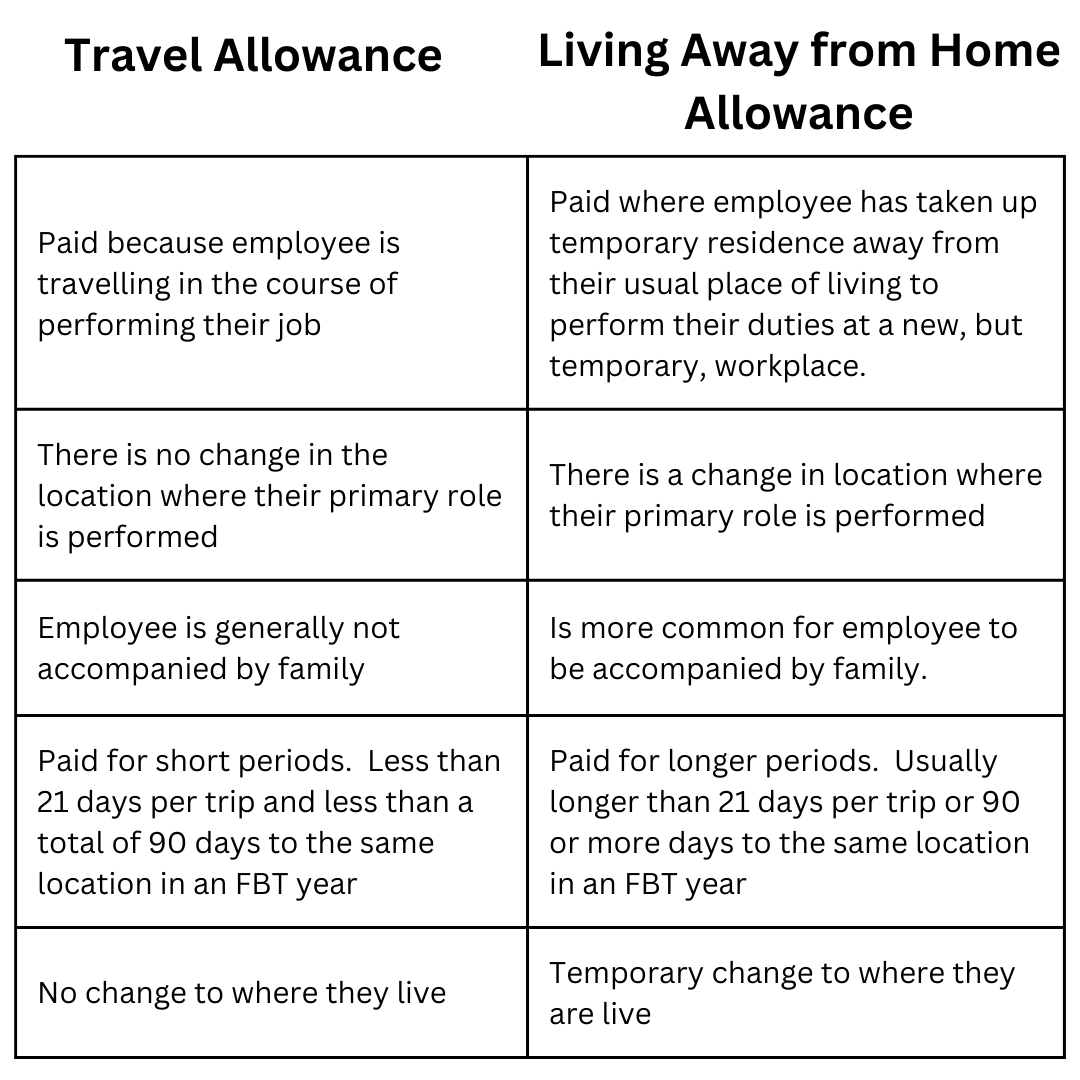

So what are the differences?

How are they treated?

Living Away from Home Allowance (LAFHA):

LAFHA is not taxed in the hands of the employee. It is actually not a even payroll item and sits in the area of Fringe Benefits for the employer.

Practically though we often see it paid through payroll to the employee.

The best way to set this up as a pay item is to do so as a Reimbursement in Xero rather than an allowance. No PAYGW is withheld, no super or leave accrued and no STP mapping required as it should not be reported for STP or W1 purposes.

Travel Allowance:

We have chosen to cover the most common situation here, that of an overnight stay.

If the allowance is being paid because the employee is required to stay away overnight for work purposes, the amount of the allowance needs to be considered in relation to the amounts stated in the relevant ATO Ruling which sets out what the ATO considers are reasonable amounts to spend on Accommodation, Meals and Incidentals. A new ruling is usually issued each July with the updated reasonable amounts for the financial year ahead. The present ruling for Reasonable Travel and Overtime Meal Allowance Amounts in relation to the year July 23 to Jun 24 can be found at td2023-003.pdf (ato.gov.au). The amounts can vary depending on where the travel is to and the income level of the employee.

Below is how we suggest you set up the Travel Allowance in this situation:

- Amount being paid is less than amounts stated in Ruling – set up as a Reimbursement in Xero called ‘Travel Allowance – under ATO Reasonable amounts’. No PAYGW withheld, no super or leave accrued and not reported for STP or W1 purposes.

- Amount being paid is greater than amount stated in Ruling – Set up as an allowance in Xero called ‘Travel Allowance – exceeds ATO Reasonable amounts’. STP mapping of Travel Allowance type RD, deduct PAYGW, no super or leave accrued, included for W1 purposes.

As you can see there is a lot to consider, if you are in doubt, find it overwhelming or not know where or how to begin to assess this in respect of your business, the Beam Team are just a phone call or email away.

Recent Beam News: